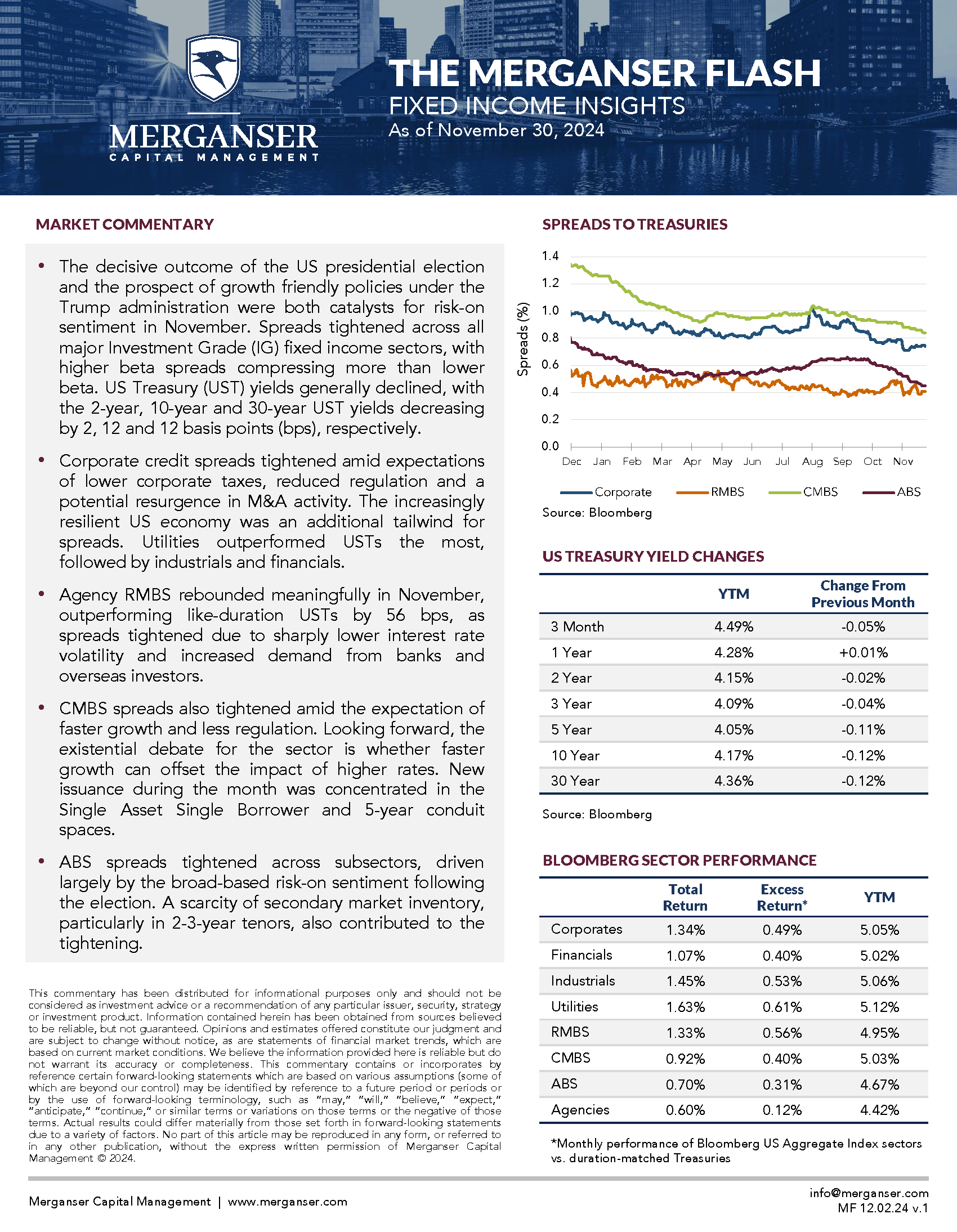

- The decisive outcome of the US presidential election and the prospect of growth friendly policies under the Trump administration were both catalysts for risk-on sentiment in November. Spreads tightened across all major Investment Grade (IG) fixed income sectors, with higher beta spreads compressing more than lower beta. US Treasury (UST) yields generally declined, with the 2-year, 10-year and 30-year UST yields decreasing by 2, 12 and 12 basis points (bps), respectively.

- Corporate credit spreads tightened amid expectations of lower corporate taxes, reduced regulation and a potential resurgence in M&A activity. The increasingly resilient US economy was an additional tailwind for spreads. Utilities outperformed USTs the most, followed by industrials and financials.

- Agency RMBS rebounded meaningfully in November, outperforming like-duration USTs by 56 bps, as spreads tightened due to sharply lower interest rate volatility and increased demand from banks and overseas investors.

- CMBS spreads also tightened amid the expectation of faster growth and less regulation. Looking forward, the existential debate for the sector is whether faster growth can offset the impact of higher rates. New issuance during the month was concentrated in the Single Asset Single Borrower and 5-year conduit spaces.

- ABS spreads tightened across subsectors, driven largely by the broad-based risk-on sentiment following the election. A scarcity of secondary market inventory, particularly in 2-3-year tenors, also contributed to the tightening.